IRS Direct File

Helping over 140,000 taxpayers file for free

Helping over 140,000 taxpayers file for free

On Direct File, I designed prototypes for the eligibility screener and workflows for the sign and submit process. I helped shape both the onboarding and submission experiences for over 140,000 taxpayers.

140,000 taxpayers served across 12 states

Expanded to 25 states in 2025

Internal Revenue Service

UX designer

A majority of taxpayers in the U.S. spend hours of time and sometimes hundreds of dollars on paid solutions to file their tax returns each season. This is particularly costly and frustrating for low-income individuals. For these folks, the extra cost can become a real burden.

As part of 18F, I worked with partners at the IRS, the U.S. Digital Service, and several civic tech contractor teams to design the first pilot of Direct File for the 2024 tax season.

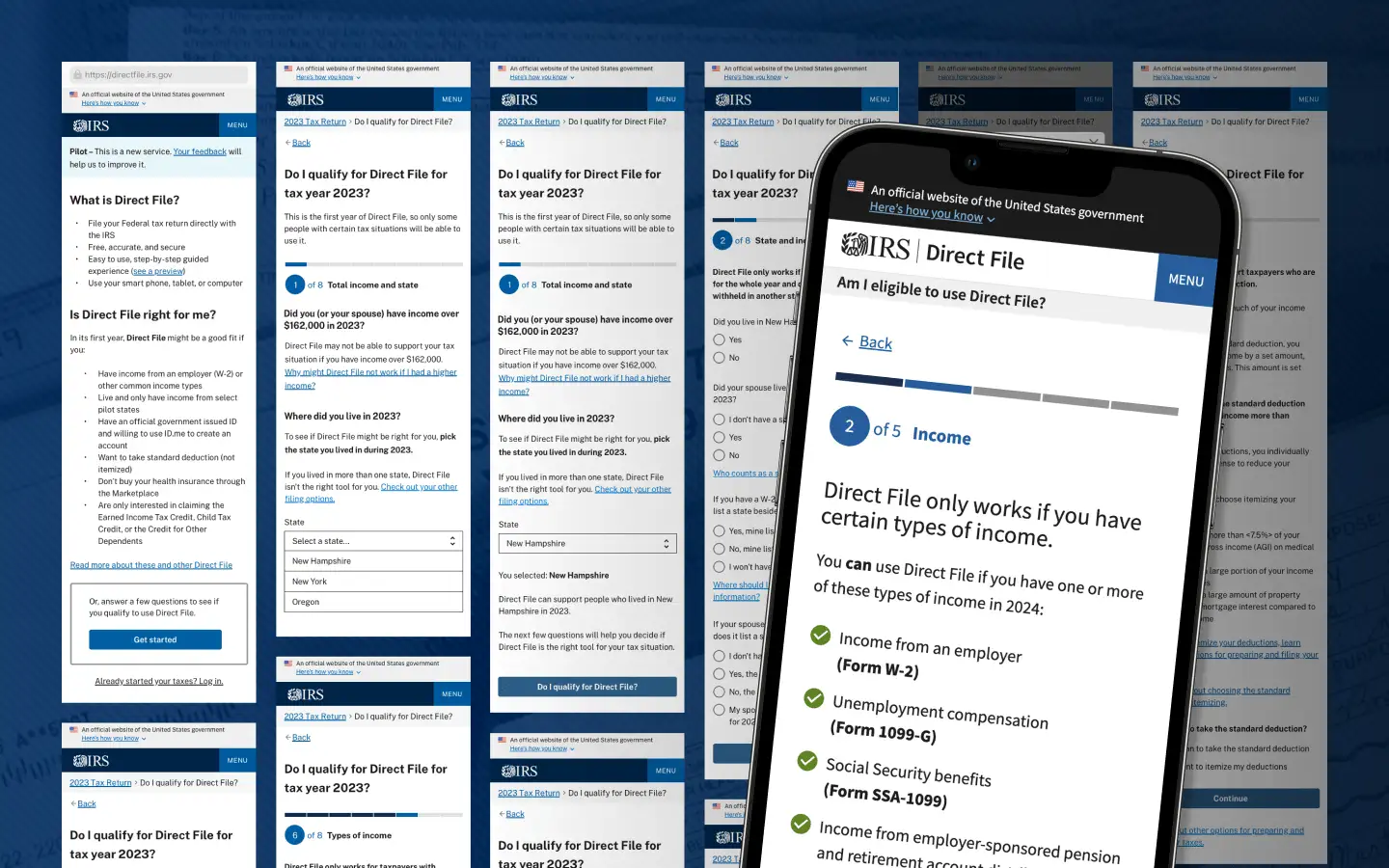

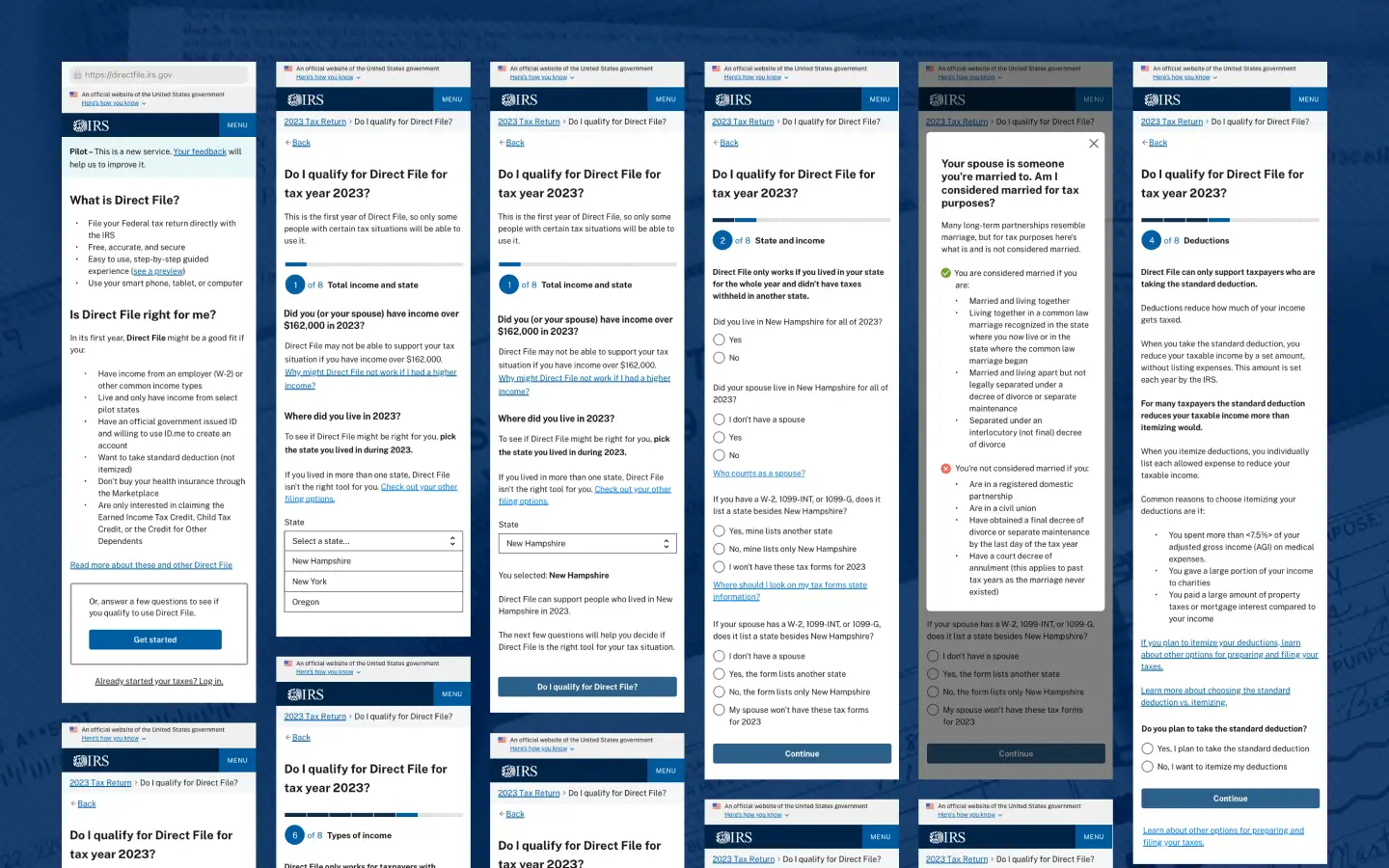

Even though Direct File greatly simplified the tax filing process, it still requires taxpayers to answer a lot of questions. I worked on the user interface and an interactive prototype for the eligibility screener. This makes sure folks know if they qualify for the pilot before diving in. Because Direct File will continue to have some limitations in its first few years, it’s crucial if people know if it will work for them before getting started.

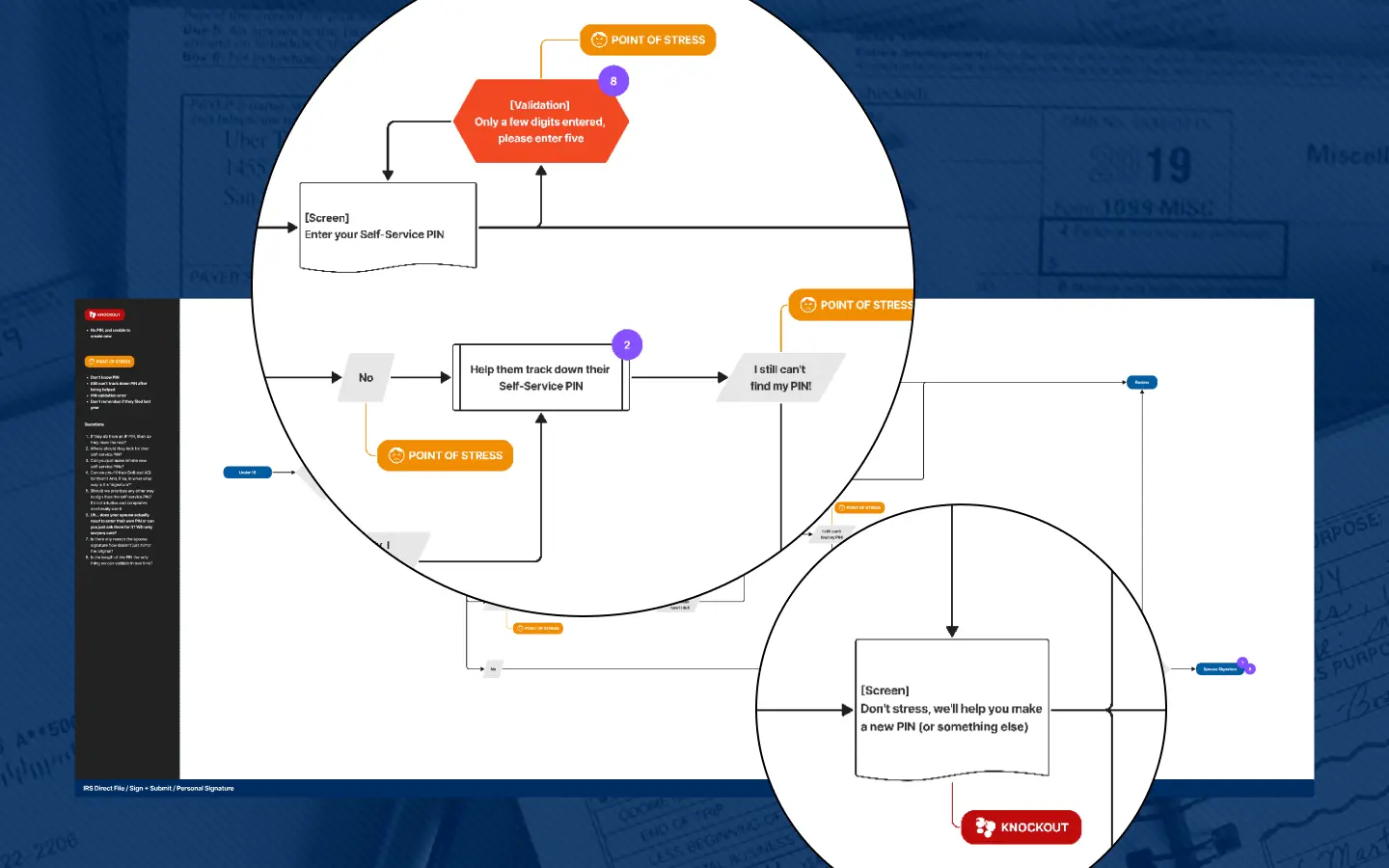

Getting to the end of your tax return and finally hitting “submit” can be a scary thing. There are multiple ways to “sign” your tax return, and there are several potential points of stress even at the end of the process. Early on in the project, I mapped out the “sign and submit” workflow. This made sure taxpayers could finish filling out their return with confidence, and set the stage to make sure they knew what would come next.

My work on the eligibility screener informed a lot of what ended up in the final product, particularly my focus on making the various lists of requirements easier to scan. My work on the sign and submit workflow uncovered several challenging questions and ultimately helped the team make some important choices about how to streamline the experience even further.

Direct File went on to serve over 140,000 taxpayers across 12 states and was generally well received by the public. The IRS announced it’s intent to make Direct File permanent in 2025, with the plan to expand to more states.